Hedging through inflationary headwinds to build resilient deal flow

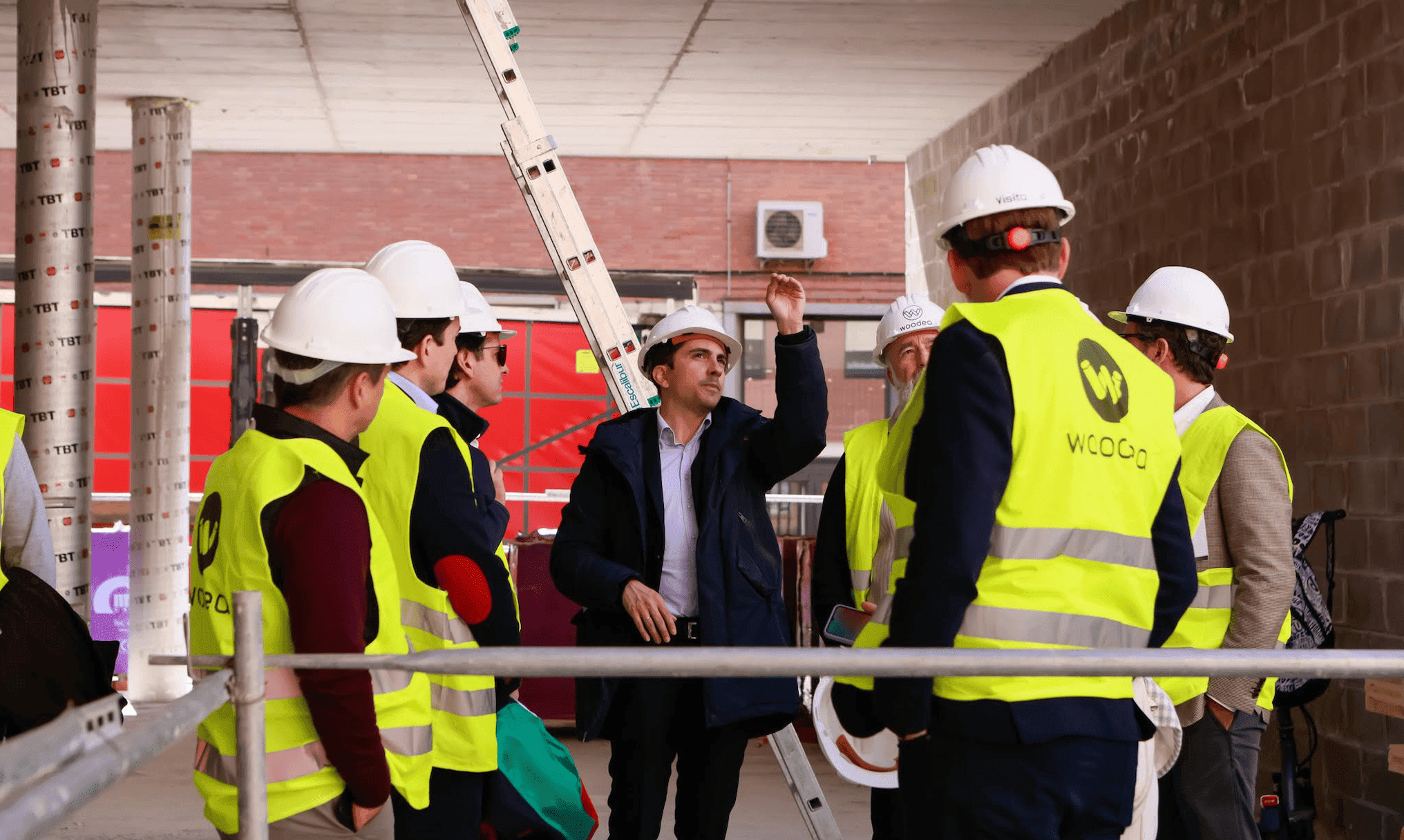

Fast becoming our flagship event for senior real estate investors, fund managers, asset owners, lenders and developers, active in the UK, as well as those with diversified pan European portfolios across countries and sectors. Create dealflow and benchmark pricing, location and risk hedging strategies with your peers. Spend real time with the right people with private investor driven roundtables. No press, no formal agendas, no stages, just qualified decision makers with risk in real estate transactions, sitting down together for closed door discussions.

Submit yout interest to

Europe GRI 2026 - Winter Edition

Our team will evalute your profile

and will get back to you soon

We take a large number of information into consideration but in short, applying leaders must meet 2 basic criteria:

a) Seniority: decision-makers only.

b) Principal: invested real estate or infrastructure companies with capital at risk.

Opening Talkshow

Macro Forces, Capital Flows, and the Deals That Will Define 2026

- Europe’s Macro Equation - Which economic forces will drive or derail real estate in 2026?

- Capital on the Move - How are global flows into Europe shifting between sectors, risk profiles, and geographies?

- The GP Playbook - What strategies will win in a low-growth, high-selectivity environment?

- Mega Deals & Market Signals – What transactions will set the tone for the year?

- Beyond the cycle - What long-term trends will reshape European real estate?

Beyond Borders

2026 Capital Deployment - Timing, Cross-Border Conviction & GCC Fundraising Strategies

- Track the Flows – Where is global capital moving in 2026 (Asia, Europe, GCC), and what’s driving it?

- Time it Right – Is 2026 the sweet spot for redeploying capital, or already priced in?

- Build Conviction Across Borders – How do investors underwrite fragmented markets and manage geopolitical perception?

- Structure Smart – Debt, equity or hybrid: what structures are winning in cross-border execution today?

- Raise & Partner Better – What do global LPs (incl. GCC capital) want now, and how do GPs turn capital into long-term alliances?

Alexander Riches

UK Deals

Where is the UK Pipeline Still Attracting Capital?

- How are real estate partnerships structuring capital, governance, and risk allocation to deliver UK projects from in the current market?

- Which UK sectors and locations are attracting the most committed capital from players, and how are return targets being recalibrated?

- What strategies are players using to de-risk delivery while protecting upside potential?

- How are new fundamentals & investment requirements from capital partners and developers influencing deal and project selection and long-term value creation?

David Evans

Flexible Living Models

Where Resilience Meets Scalable Growth?

- Flex Demand Drivers Is demand more driven by housing shortages or changing lifestyles? And how consistent is it across European cities?

- Investment Viability Can co-living and flex-living offer scalable, long-term returns? Or are they still tied to very specific locations?

- Operational Complexity How do short stays and high service levels impact margins? Are we ahead of operational demands already?

- Regulation & Standardization Are local rules limiting growth across markets? What is needed to build a more stable, cross-border framework?

Italy’s Real Estate Market - From Crossroads to Comeback?

- Sector Outlook - From hotels and housing to offices, retail, and logistics: diamonds in the rough ready for a renaissance, or white elephants dragging their feet?

- Market Fundamentals - Italy’s real estate a sleeping giant ready to awaken, or an old dog stuck in its ways?

- Regional Disparities - Milan calling the shots while the South lags, or can every region get a piece of the pie?

- Capital Flows - Foreign capital flocking to Italy like bees to honey, or steering clear of stormy weather?

- Future Outlook - Italy poised for a renaissance in real estate, or just kicking the can down the road?

Francesco Mantegazza

Europe’s Light Industrial & Logistics

Overcrowded, saturated or the next strategic pivot?

- Investment Momentum - Capital to keep flowing or start to pull back?

- Vacancy Levels - Stay tight or loosen further?

- Macro Risks - Will trade headwinds persist or ease?

- Favorable Capital Conditions - Temporary cheap money or tightening up?

- 2026 inflection point - Are we at saturation or a strategic pivot?

Fabrizio Lauro

Where Smart Capital Moves

Equity Repricing, JVs & Value-Add Returns in Europe

- Where Smart Capital Moves – How are investors reallocating equity across geographies and asset classes as repricing reshapes Europe?

- Deploying Dry Powder – What’s the winning strategy for timing deployment: wait for clarity or move early for first-mover advantage?

- Alignment & Governance – What breaks down most often in JV partnerships under stress, and how can it be prevented from day one?

- Underwriting & Structuring – How are LPs and operators bridging gaps on debt costs, leasing, capex, timelines and downside protection?

- Decision Rights, Liquidity & Exit – When conditions shift (refinancing tightens, plans change, capital calls hit), who calls the shots, and what’s changing in hold periods and exits into 2026?

Jatin Ondhia

Capital Stack Realignment

Managing Risk Across the Layers

- How are players adjusting the balance between equity, mezzanine, and senior debt to align with today’s market risk profile?

- Where do players see the greatest opportunity or vulnerability across the capital stack in their current portfolio or pipeline?

- How are players structuring partnerships or co-investments to bridge funding gaps while preserving control and returns?

- What stress-testing or downside protection measures are players prioritizing to safeguard each layer of the stack in a volatile market?

Joe Freedman

Investments Opportunities in Spain

A strategic piece into Europe's real estate chess match?

- Spain Fundamentals What elements are sustaining Spain’s investment momentum? How are macro conditions and demographics influencing demand across sectors?

- Investment Priorities Which asset classes are shining the most and why? Are investors focusing on core assets or value-add plays too?

- Entry Strategies How are international and domestic players securing prime opportunities? Are partnerships and platform deals becoming the preferred route?

- Competitive Positioning With rising interest from global capital, how can investors differentiate and capture the best deals in a crowded market?

Juan Alonso Bartolome

Germany

Bringing capital stability back or tough test ahead?

- Stability or slide Is German capital deployment regaining traction or close to stalling again?

- Residential resilience Are multi‑family and residential holding firm or over‑priced illusions?

- Regulatory risk Can reform, zoning fixes and stimulus crack the approval bottleneck?

- Debt pressure Will liquidity‑strained funds and distressed lenders trigger forced exits or opportunity?

Retail

What’s investable, what’s obsolete, and where is reactivation happening?

- Mixed-Use Strategy Double down on integration or keep retail standalone?

- Tenant Mix Focus on experiential/service-led or stick with traditional anchors?

- Prime Yields Compression ahead or plateauing at current levels?

- Debt, Lending, and Financing Loosen up in 2026 or remain selective?

- Investor Appetite Grocery-anchored, outlets, and parks as the safe bet or look beyond the obvious?

- Asset Management Rely on traditional leasing expertise or pivot to data-driven decision-making?

BTR and PBSA

Still Compelling for Capital?

- Demand Resilience - Is demand strong enough to sustain occupancy and rent growth?

- Investment Thesis & Pricing - Are investors prioritising income, growth, or a mix of both?

- Development Constraints - Are costs, planning, and land scarcity limiting new supply?

- Operations & Value Creation - Does operational quality materially drive performance and value?

- Cross-Border Scalability - Can platforms scale efficiently across European markets?

Daniel Harris

Asset Repositioning

What are the key strategies for future rewarding assets?

- Asset Transformation Models - Opportunistic or strategic approach to adapting and converting assets?

- Underwriting & ESG Integration - Core value driver or compliance necessity for future returns?

- Financing Strategies - Debt restructuring or equity partnerships for capital-intensive repositioning?

- Sector Conversion - Which asset classes present the strongest repositioning upside in 2026?

José Antonio de Pedro Cuadrado

Debt & Credit in Southern Europe Deals

Do we see the rise of a new debt cycle in the region?

- Lenders Appetite Are traditional and alternative lenders ready to expand exposure in the region? How are macro conditions shaping their risk tolerance?

- Pricing & Financing Terms How are interest rates, spreads, and covenant structures evolving? Are borrowers finding room to negotiate in the current cycle?

- Capital Sources Share How is the competition between bank financing and alternative capital? Which structures are proving most efficient for large-scale deals?

- Lending Strategies Which sectors and geographies are attracting the most financing activity? Are lenders targeting only core markets at the moment?

CEE Allocation Changes

What's the new and next Capital Movement?

- Capital Allocation Trends Investors retreating or reshuffling within Poland, Czechia, and Hungary?

- Asset Class Rotation Logistics leading, or capital flowing to PRS, offices, and emerging alternatives?

- Local vs Global Domestic players filling the gap as foreign capital retreats? Who are the new international entrants?

- Risk & Returns How are yield expectations adjusting in light of political, currency, and market volatility?

- Distress & Opportunity Equity stepping back as debt capital rises?

Europe’s Net Zero Real Estate - Stranded Assets or Sustainable Success?

- EU Policy Framework - Green Deal the wind in our sails, or a ball and chain for real estate investors?

- Carbon Regulations - Rising carbon prices to light a fire under retrofits, or leave laggards out in the cold?

- Financing Tools - Green bonds and EU incentives the golden goose, or just a drop in the ocean?

- Investor Pressure - Institutional investors leading the charge, or simply covering their backs?

- Regional Disparities - Is Europe a level playing field, or a tale of two markets?

Hans Vrensen

Real Estate Refinancing and Maturing Loans

Risk, Return, or Default?

Aparna Sehgal

Hospitality Deals

How differentiated ops models preserve capital and where to place the best bets?

- Which market and asset characteristics are players prioritizing to identify high-conviction opportunities amid pricing dislocation?

- How are players determining the optimal balance between experience-led enhancements and efficiency-driven operations to preserve asset value?

- Which hospitality segments are players finding deliver the strongest capital resilience under current market conditions?

- How are players quantifying the long-term valuation impact of brand differentiation versus cost optimization?

- What hybrid operational strategies are players adopting to capture both premium rates and stable margins?

Carlo Paguio

Data Centres

Powering Europe’s digital backbone or stalled by power and land constraints?

- Data Centres Surge or Saturation – Where will Real Estate Capital Meet Digital Demand?

- Europe’s Digital Backbone – Is fundraising the Growth Engine or Bottleneck for Investors?

- Site Selection Pressures – Race for power, fiber, and land: a manageable challenge, or a throttling new development?

- Public-Private Coordination – Can governments, tenants, and developers align quickly enough to meet demand, or will fragmented collaboration stall expansion?

Partha Sarathy

Capital Markets in Motion

Pricing Risk in an Uncertain Cycle

- How are players adjusting risk premium expectations across sectors given the current stage of the cycle?

- Which market signals would prompt players to shift from defensive positioning to a new phase of capital deployment?

- How are players prioritizing capital allocation between resilient core sectors and opportunistic plays in repriced or distressed assets?

- What role does cross-border capital play in players’ strategies under today’s macroeconomic uncertainty?

Offices Resetting Expectations

Vote of confidence or not for me?

- Prime vs. Secondary CBD winners or secondary rebound?

- Interest Rates Game changer or short-term boost?

- Development Strategy New builds or retrofit-to-core?

- Tenant Experience Amenities focus or flexibility first?

The 2026 Capital Mandate:

Scale, Local Edge, and Real Alignment on GP Strategies

- What’s raising in 2026: Which strategies and proof points get LPs conviction - and what’s getting sidelined?

- Sourcing & Execution - How to position your platform strategy with pan-European scale vs local execution?

- Operating playbook: how to handle with asset management and truly differentiate strategies to preserve asset performances?

- Winning long-term LP partnerships: which structures lock in alignment while preserving market capabilities?

He worked on all types operations: development, yield investment, property trading transactions and supervised more than 500 commercial Real Estate transactions. Jean-Philippe started his career structuring Real Estate investment funds. He then moved to BNP PARIBAS where he held various positions in the Real Estate market. Jean-Philippe graduated from IEP Paris and ASSAS University, Paris.

Special Rate

Book your stay at London Hilton on Park Lane, with Special Rate available for GRI Attendees.

Use this link for booking

Our team will get back to you soon

for Premium members

Your Account Manager will be notified and will get back to you soon!

Thank you for your interest

If you have any doubts, please send us a message at: [email protected]

Please enter your business email

Perfect, thanks.

Click below to proceed with your registration

Great!

Your participation in the online event is confirmed.

This event wer have the option to participate in person.

Are you interested?

By continuing we'll assume you're on board with our privacy policy